The insurance sector is one of the most complex and regulated industries globally. With evolving customer expectations, changing compliance standards, and fierce market competition, insurance companies need their workforce to stay agile, knowledgeable, and efficient.

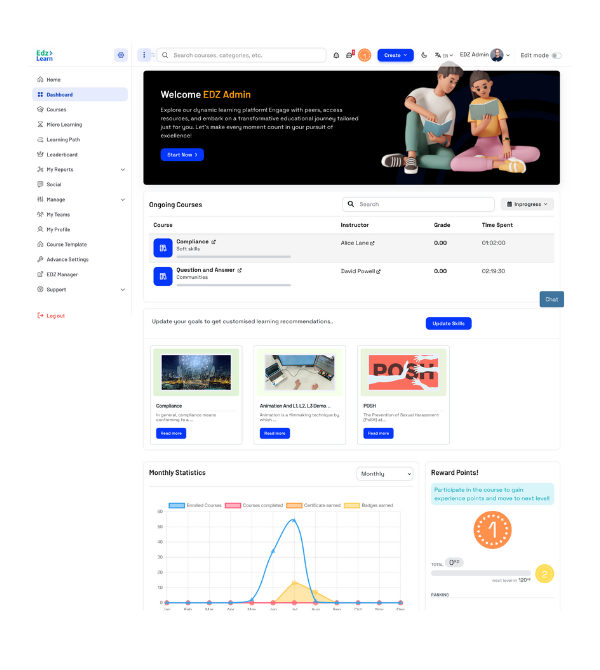

This is where a Learning Management System (LMS) steps in as a game-changer.

An LMS isn’t just an education tool—it’s a strategic partner in preparing insurance employees to perform better, adapt faster, and meet business goals.

Let’s dive deep into how an LMS transforms the insurance sector and supports each role in the organization.

Why the Insurance Sector Needs an LMS

The insurance world thrives on expertise, customer trust, and timely decision-making. But with regulations changing rapidly and products becoming increasingly complex, traditional classroom training simply can’t keep up.

Here’s why an LMS becomes essential:

- Scalable training for large, dispersed teams

- Instant compliance updates and certifications

- Faster onboarding for new agents and brokers

- Continuous professional development without disrupting work

- Performance tracking to identify knowledge gaps and improvement areas

An LMS ensures every employee—whether a field agent or a claims manager—has access to the learning they need, when they need it.

How an LMS Helps Different Roles in the Insurance Industry

Each position in an insurance company has distinct training needs. Here’s how an LMS can be tailored to support them:

1. Insurance Sales Agents

Needs:

Product knowledge, sales techniques, client handling skills, and compliance awareness.

How LMS Helps:

- Microlearning modules on new insurance products.

- Interactive sales simulations and roleplays.

- Certification courses on ethical selling practices.

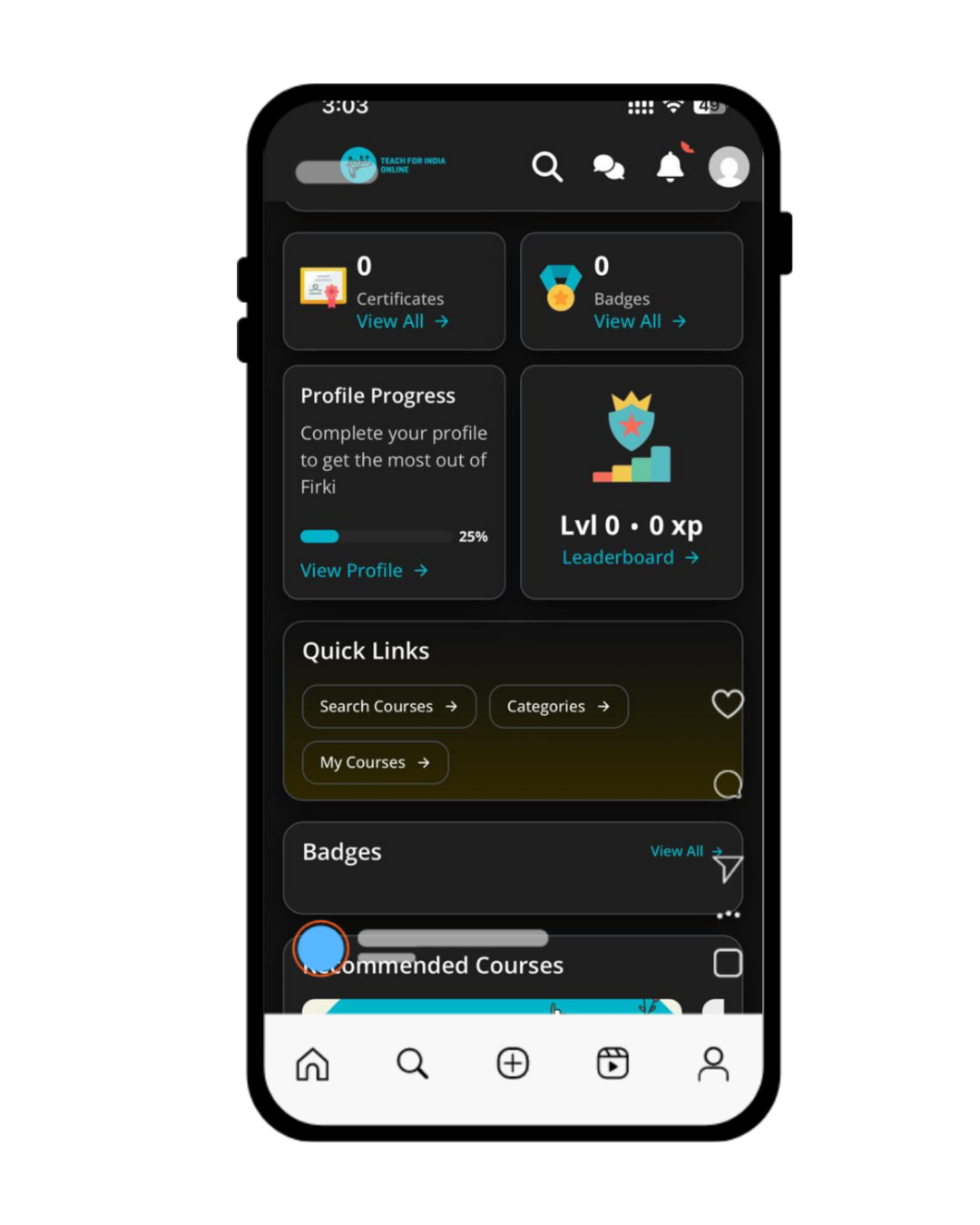

- Gamified leaderboards to motivate performance.

Result? Faster onboarding, improved client interaction, and increased sales conversions.

2. Underwriters

Needs:

Risk assessment, underwriting guidelines, data analytics, and decision-making skills.

How LMS Helps:

- Interactive risk evaluation case studies.

- Regular updates on underwriting policies and compliance.

- Scenario-based learning to sharpen decision-making.

- AI-powered assessments to evaluate understanding.

An LMS ensures that underwriters make informed, consistent, and compliant decisions.

3. Claims Adjusters and Examiners

Needs:

Fraud detection skills, negotiation techniques, and policy analysis.

How LMS Helps:

- Real-world claim processing simulations.

- Modules on fraud prevention and ethics.

- Video tutorials on system updates and case management tools.

Training claims teams through LMS improves accuracy, reduces claim settlement times, and minimizes fraudulent payouts.

4. Customer Service Representatives

Needs:

Product knowledge, soft skills, problem resolution, and empathy training.

How LMS Helps:

- Interactive customer scenarios and resolution practice.

- Soft skills modules focused on empathy, patience, and professionalism.

- Up-to-date knowledge base access through mobile learning.

Empowered customer support teams boost client satisfaction and loyalty.

5. Compliance Officers

Needs:

Regulatory changes, company policies, risk management.

How LMS Helps:

- Real-time compliance updates pushed via LMS alerts.

- Mandatory certification tracking.

- Automated renewal notifications for compliance certifications.

LMS systems help compliance teams proactively manage risks and avoid penalties.

6. Executives and Managers

Needs:

Leadership development, strategic thinking, business acumen.

How LMS Helps:

- Executive education programs and leadership workshops.

- Advanced data analytics to monitor team learning progress.

- Custom dashboards to track overall organizational learning health.

A well-trained leadership team leads to stronger organizational growth and competitive advantage.

Unique Benefits of LMS for the Insurance Sector

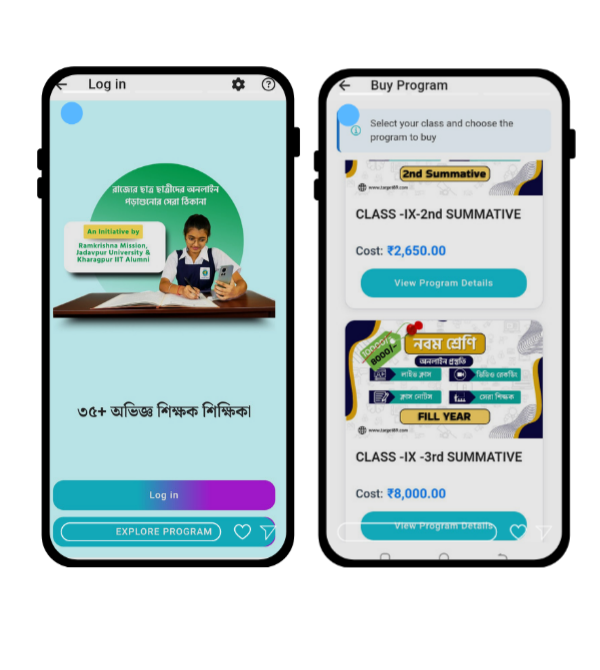

1. Anytime, Anywhere Learning

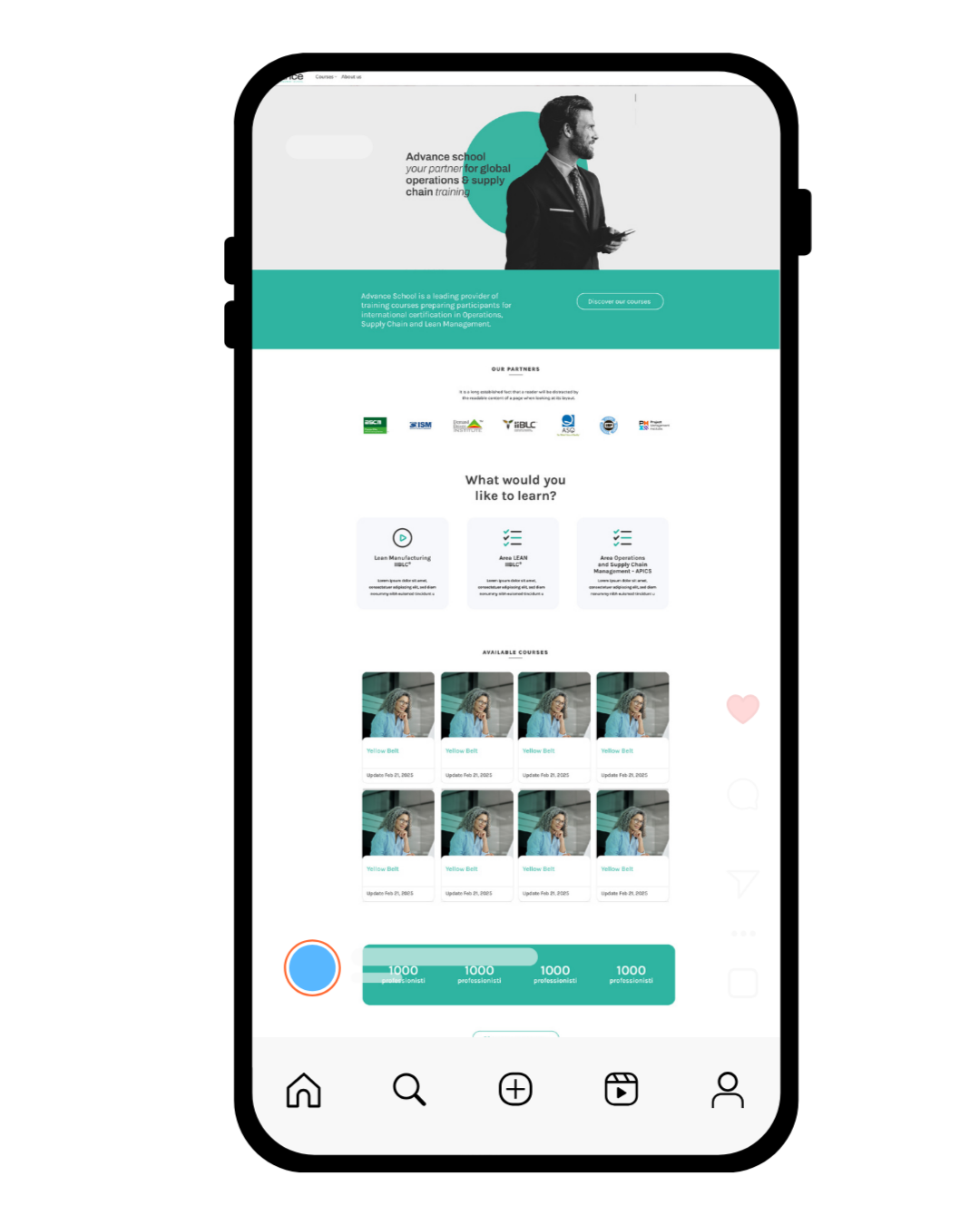

Insurance professionals often travel and manage unpredictable schedules. Mobile-enabled LMS platforms allow them to learn on the go, completing courses from laptops, tablets, or phones.

2. Customized Learning Paths

Different job roles require tailored learning journeys. LMS platforms can create customized paths—ensuring employees focus on what’s truly relevant to their role and career path.

3. Faster Compliance Management

Given the heavy regulatory load on insurance, LMS platforms automate compliance training, track certifications, and even issue audit-ready reports when needed.

4. Cost-Effective Training

With no need for printed materials, travel, or instructor fees, LMS platforms drastically reduce training costs—while reaching a wider audience.

5. Boosted Employee Retention

Training is one of the top factors influencing job satisfaction. Offering continuous learning opportunities through LMS shows commitment to employee growth—leading to better retention rates.

How LMS Elevates Key Training Programs in Insurance

- Product Training: Whenever a new insurance product is launched, LMS platforms can instantly deploy training modules across branches.

- Regulatory Compliance: New regulations? LMS can ensure all employees complete required training within deadlines.

- Sales Enablement: Regular refreshers help sales teams perfect their pitches and improve closing rates.

- Claims Handling: Training scenarios make claims processing more efficient and client-friendly.

Challenges LMS Solves for Insurance Companies

Without an LMS:

- New employees face a steep learning curve.

- Teams struggle to keep pace with regulatory changes.

- Compliance risks increase.

- Training costs spiral upward.

- Learning progress is difficult to track.

With an LMS:

✅ New agents are productive faster.

✅ Compliance is consistent and auditable.

✅ Training costs are optimized.

✅ Employee performance is measurable.

✅ Learning becomes a business enabler.

Conclusion: Future-Proofing Insurance Training with LMS

The insurance landscape is changing faster than ever—with new technologies, customer expectations, and compliance demands reshaping the industry. In this high-stakes environment, knowledge isn’t just power—it’s a competitive advantage.

An LMS isn’t just a “nice to have” for insurance companies—it’s essential.

It empowers every department: from the agents interacting with customers to the compliance officers safeguarding the company’s future.

By investing in a robust LMS, insurance firms can deliver faster onboarding, smarter compliance training, continuous upskilling, and measurable business outcomes.

The future of insurance belongs to companies that don’t just insure their clients—but also invest in the knowledge and expertise of their employees.

And an LMS is the smartest investment they can make.

This Blog is Written By Ritika Saxena,

Content Writer and Social Media Manager At

Edzlearn Services PVT LTD.

For More Information Connect With Her on Linkedin : https://www.linkedin.com/in/ritika-saxena0355/

Read our Recent Blogs: https://edzlms.com/blogs/

Download our Recent Case Study: https://edzlms.com/case-study/For anything related to LMS, feel free to reach out or book an appointment at : https://calendly.com/edzlms/30min.