Use EdzLMS to train insurance agents

LMS for Insurance Industry

LMS for Insurance Industry : EdzLMS’s advanced self-paced learning features can help you train insurance agents and grow your business.

Trusted by more than 400 global clients

EdzLMS FOR

LMS for Insurance Industry: Transform Training and Compliance

Tailored Insurance Courses for Point of Sales Personnel

Provide specialized insurance training courses with customized access durations and comprehensive practice exams. Set a course fee for immediate access to all instructional videos and exam materials upon purchase.

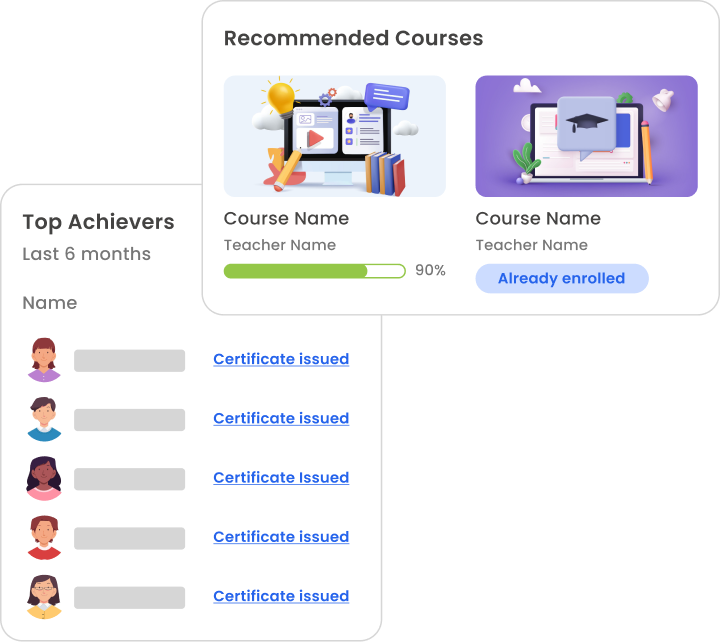

Instant Digital Certificates

Upon successful completion of courses and exams, learners can instantly download their digital certificates and receive them via email, ensuring swift verification of achievements.

Streamlined Administrative Reporting

Easily generate and access administrative reports as an administrator to monitor candidate progress and facilitate timely course completion.

DELIVER STRUCTURED LEARNING

Automated Certificate Generation

Implement a conditional access system within your courses, where completion of SCORM modules or videos automatically progresses learners to assessments. Upon achieving a passing grade, EdzLMS seamlessly generates and distributes digital certificates.

Pricing, Coupons, and Shopping Cart Management

Utilize flexible pricing strategies and promotional coupons to enhance sales conversions. EdzLMS simplifies the creation and administration of discounts, ensuring seamless management of your online course offerings.

SUPPORT PORTAL

Support Portal with Ticketing System

As a leading LMS for the insurance industry, EdzLMS offers a comprehensive suite of features designed to streamline your operations and enhance customer satisfaction. Efficiently manage customer inquiries with EdzLMS’s automated support portal. Automatically assign tickets to appropriate customer service representatives and utilize auto-response features to streamline communication and save valuable time. Our LMS empowers insurance companies to deliver exceptional customer service and improve overall efficiency.

CONTENT

Comprehensive Insurance Agent Training

Content EdzLMS provides comprehensive training content tailored for insurance agents, meticulously curated to align with IRDA guidelines. Modular courses cover General Insurance, Health Insurance, and Life Insurance, enabling real-time tracking of learning progress, post-assessments, and issuance of completion certifications.

INSURANCE TRAINING

Insurance Training Impact

Facilitating over 35,000 insurance training certifications monthly, EdzLMS supports organizations like the Insurance Institute of India in delivering scalable and effective learning experiences. Our platform empowers individuals to proactively manage their career paths and personal development goals.

“Using EdzLMS opens up opportunities to our people to

be able to choose which career path they're interested in,

to get ahead of the game on career and personal development.”

EBOOK

Provide Interactive Ebooks

Enhance your learning experience with interactive ebooks on EdzLMS, featuring assessments, note-taking, and annotation capabilities.

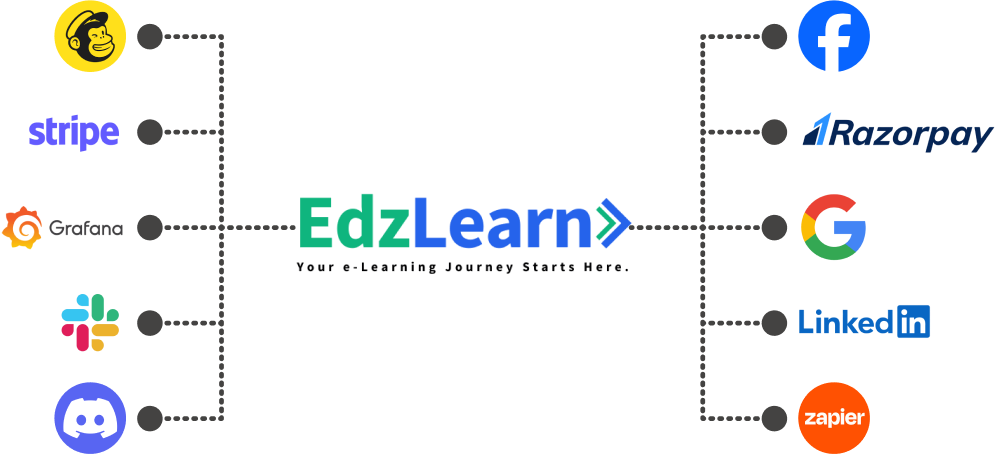

INTEGRATE

Integration Capabilities

Streamline operations and maximize efficiency by integrating EdzLMS with your existing tech ecosystem. Automate workflows, facilitate data flow, and empower your team with more time to focus on strategic priorities.

Start selling posp courses today.

Click below to book a demo now

FAQ Section: LMS for Insurance Industry

1. What is an LMS for the Insurance Industry?

An LMS (Learning Management System) for the insurance industry is a specialized platform that helps insurance companies manage training, compliance, and professional development. It streamlines the process of onboarding new employees, ensuring regulatory compliance, and providing continuous education for agents, brokers, and other staff members.

2. Why does the insurance industry need an LMS?

The insurance industry requires an LMS to ensure that employees are adequately trained on complex regulations, product offerings, and industry best practices. An LMS enables consistent training, helps with compliance tracking, and supports continuous learning in a rapidly changing regulatory environment.

3. What are the key features of an LMS for Insurance Companies?

An effective LMS for insurance companies should include:

Compliance Tracking: To monitor employees’ adherence to regulatory requirements.

Customizable Training Modules: Tailored content for insurance products, laws, and procedures.

Certification Management: To track certifications required for roles within the insurance industry.

Mobile Accessibility: To ensure agents and employees can access training from anywhere.

Reporting and Analytics: To track progress, completion rates, and performance across teams.

4. How can an LMS improve compliance in the insurance industry?

LMS platforms help insurance companies streamline compliance training by offering standardized training programs, ensuring employees stay up to date with changing regulations. They also automate tracking and reporting, making it easier to monitor employees’ compliance status and audit records.

5. Can an LMS help with insurance product training?

Yes! An LMS can be customized to deliver specific training on insurance products, underwriting procedures, claims management, and sales techniques. It ensures that employees are well-equipped with the knowledge to handle customer inquiries, sell products, and manage claims effectively.

6. What are the benefits of using an LMS for insurance company employees?

Some of the key benefits include:

Efficiency: Streamlined, consistent training reduces the time spent on onboarding and ongoing education.

Improved Compliance: Automated tracking ensures that all employees meet regulatory training requirements.

Enhanced Employee Performance: Continuous learning opportunities help employees stay up-to-date with industry trends, improving overall performance.

Scalability: As your company grows, an LMS can easily scale to accommodate new hires and changing training needs.

7. What types of insurance companies can benefit from an LMS?

All types of insurance companies, whether they focus on life, health, property, casualty, or specialty insurance, can benefit from an LMS. Each sector requires specific training for agents, brokers, underwriters, claims adjusters, and other roles within the organization.

8. What are the costs associated with an LMS for the insurance industry?

The cost of an LMS for insurance companies can vary depending on factors such as the number of users, features required, and the level of customization needed. There are subscription-based models, perpetual license models, and pricing tiers based on the size of the company and the complexity of the LMS.

9. How do I choose the right LMS for my insurance company?

When choosing an LMS for your insurance company, consider the following factors:

Customization: Ensure the platform can be tailored to your industry-specific needs.

Compliance Features: Look for robust compliance tracking and reporting tools.

Ease of Use: The system should be user-friendly for both administrators and employees.

Integration: Ensure the LMS can integrate with your existing systems, such as CRM and HR software.

Support: Choose a provider that offers strong customer support and training resources.

10. Can I integrate an LMS with other systems in my insurance company?

Yes, most modern LMS platforms offer integrations with CRM systems, HR platforms, and other software commonly used in the insurance industry. This ensures that the training system aligns with your company’s workflow and reporting needs.

11. Is there a mobile version of the LMS for insurance agents in the field?

Many LMS platforms offer mobile-friendly versions, allowing insurance agents and employees to access training materials on their smartphones or tablets while in the field. This is particularly useful for agents who need continuous learning resources during client meetings or while traveling.

12. How do I track employee performance and progress with an LMS?

LMS platforms often come with built-in reporting tools that allow you to track employee progress, completion rates, and performance. You can monitor how well employees are performing on courses, certifications, and tests, providing valuable insights into areas for improvement.

13. Can an LMS be used for both onboarding and ongoing training in the insurance industry?

Yes, an LMS is ideal for both onboarding new employees and providing ongoing training. For onboarding, it can deliver introductory courses, insurance industry overviews, and product training. For ongoing training, it can offer updates on new regulations, insurance products, and sales techniques.

14. How long does it take to implement an LMS in an insurance company?

The implementation time for an LMS in an insurance company depends on the size of the organization, the complexity of the training materials, and the customization needed. On average, it can take anywhere from a few weeks to a few months for full deployment and training.